In small companies, a limited liability corporation (LLC) is a common business form because of its simplicity of operation, tax advantages, as well as liability protection for the company’s shareholders. However, there are charges associated with founding and maintaining an LLC. Whereas the initial filing fees may be reasonable, there are extra expenditures and recurrent obligations, like taxes, that you should take into consideration before moving further.

The amount of tax you’ll have to pay is determined by the state in which you incorporate your LLC or whether or not you engage an expert to assist you. During this section, we’ll go over the various sorts of initial and recurring costs that you’re likely to encounter while forming an LLC. Know about the cost and fee before you consider any LLC formation package-

Fees for Forming a Limited Liability Company

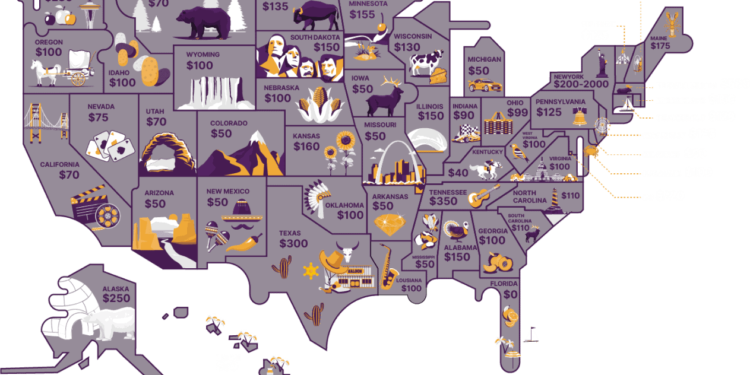

Articles of Organization (also known as a Certificate of Formation or a Certificate of Organization) must be filed with the proper government in your state in order for your LLC to be legally formed and operate. Depending on the state, this price can range from $40 to even more than $500, with only an average cost of around $100 to $150.

Operating Agreement for a Limited Liability Company

It is extremely suggested that every limited liability company (LLC) have an operating agreement. Operating agreements are not subject to a filing fee, and they can be written by the business owner or created using a free template. You may, on the other hand, want to have an attorney assist you, or you may like to utilize a paid template or even other professional services. The cost of drafting an LLC operating agreement might range from zero to more than $1,000, depending on your choice of legal structure.

Taxes at the source (pass-through taxation)

Corporations are subject to taxation on both their company profits and their personal income tax filings. Double taxation is the term used to describe this situation. Pass-through taxes are permitted by LLCs, which implies that earnings are distributed to the members of the LLC. You would then declare any profits on your personal tax form rather than having to file two separate tax returns for the same amount of money. As a consequence, you may keep more of your profits since you won’t be subjected to double taxes.

It is simple to get started.

Creating an LLC on your own is a fast and very straightforward process that can be completed in a few minutes. In contrast to C companies, creating an LLC involves a minimal amount of documentation. Also avoided are annoyances such as being forced to have yearly meetings at which you must document minutes of the meeting or give formal officer duties to new officers.

Franchise Tax is levied on a yearly basis.

While LLC earnings are not subject to direct taxation, some states impose a yearly flat tax on all LLCs, despite the fact that LLC profits are not subject to direct taxation. In California, the minimum tax is $800 per year, with no exemptions. Other states, including Delaware, have a lesser fee, which is $250 per year instead. It is also considered among the LLC formation package by most of the providers.

Fees for Filing Reports

In addition to your LLC filing expenses, most states need yearly payments, which are commonly referred to as reporting fees, in order to keep your LLC in good standing. In jurisdictions such as New York, these costs can grow based on the number of partners you have, ranging from a minimum of $325 to a maximum of $10,000, depending on the number of partners you have. Other states impose a smaller flat cost, with some charging as little as $20 per year. This charge is in addition to just about any franchise taxes that may be applicable.

Taxes are levied by the federal government.

One of the advantages of having an LLC is the fact that it is subject to federal pass-through taxation. Profits earned by the LLC will not be subject to taxation. Instead, the owners, who are referred to as members, will be responsible for paying tax on their individual tax returns.

However, if your firm has workers, you will be required to pay federal payroll taxes, which include FICA and the federal unemployment tax.

As we’ve seen, there are several expenses associated with forming an LLC. It may seem intimidating and pricey at first, but keep in mind that rates vary depending on whatever state you’re in and what licenses you may need for your particular company venture. If you do not want to get your head into these complications, then you can consider an LLC formation package.