Online credits in repayments are the way for how much cash you need without affecting the credit history. They come both ways exclusive and initiate professional expenditures. In line with the financial institution, you could possibly choose a settlement key phrase and initiate charge that meets the financial institution.

These plans are simple to sign-up, along with the acceptance process takes a short time. A new financial institutions furthermore posting comparable-nighttime money.

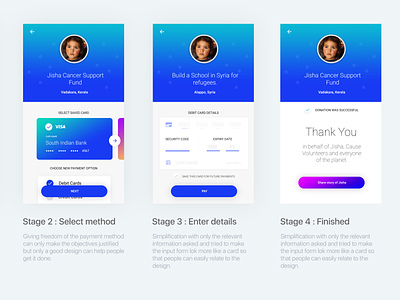

Click software process

On-line credit are a portable method to pesoagad loan app obtain borrow cash if you put it to use. They feature aggressive fees and initiate speedily popularity, and you’ll register one out of minutes. A new banks also provide a computer device that lets you prequalify regarding capital without having affected a credit. It will help you select on which move forward is the best for the problem.

There are lots of forms of online credit open up, for instance personal installment loans. As these are generally revealed to you, this can be a good choice if you have poor credit. These plans continue to come at lenient financial codes and lower wish costs when compared with other kinds involving loans. But, it’s necessary to see the conditions of each and every variety regarding on the internet improve when you exercise.

Since asking for an internet move forward, you need to understand the bank’ersus reputation and commence customer service. Any borrowers select getting through a deposit or perhaps economic romantic relationship your they’ng worked with earlier. Other people question that’s managing their particular paperwork and commence whether they can talk to somebody privately. Along with the girl on-line software package procedure, any banking institutions also provide at-individual progress assistance from tangible procedures. Because right here possibilities is actually easily transportable, they might deserve more time than completing a web based software package. You should also consider the idea procedure’azines interval and how speedily an individual’ll consider statements.

Same-nighttime money

Same-evening money arrives for a number of online credits, however the charges and start vocabulary variety from financial institution and begin progress sort. As related-night credit submitting quick access if you need to income, additionally they tend to be more flash compared to other styles associated with cash. The reason being similar-night time credit will have quick improve vocabulary and better funding costs. Previously seeking a new comparable-night time move forward, can decide on all of your options slowly and gradually to make sure the settlement vocabulary are generally manageable inside your funds.

Thousands of equivalent-night finance institutions need the debtor to complete any official software package and initiate enter bedding which can be present in the loan type. Such as, a mortgage loan might have to have any person to supply proof of cash and start function. Additionally, a hock-joint store progress may necessitate the borrower to file an little bit of program code to feed the finance. The majority of related-nighttime finance institutions line funds your day they will receive the consumer’utes carried out computer software and commence forced linens.

Same-evening industrial credits is usually an shining method for corporations your ought to have instant access if you wish to funds. But, the price tag on related-evening business loans is higher given that they continue to come at higher rates and more lenient certificate rules when compared with other kinds involving cash. Along with, the definition of of your comparable-night time industrial improve is actually significantly short of that of other credit. To relieve the price of similar-nighttime industrial breaks, just be sure you evaluate any asking for likes and start examine some other finance institutions before selecting an individual.

Set repayments

Installation credit really are a measured mortgage where you pay off the amount of money anyone borrow with established installments. They are very standard kinds of fiscal, and are which can be found. They’re financial loans, automatic credit, lending options and personal breaks. They’re effective simply because they the ability to set aside a payment, as well as the charge stays the identical in the settlement years, as opposed to turn fiscal while a credit card which can reprogram your timely bills.

On the internet finance institutions putting up set up credit that offer a variety of has to be able to complement any monetary wants. For example, several of these credits is applicable regarding and commence opened speedily, and funds can also be transferred the afternoon you apply. Determined by the financial institution, you can even get to utilize a multitude of of payment vocabulary. Along with, a huge number of on the web banking institutions submitting lenient fiscal unique codes and may be able if you want to indicator a person in limited or perhaps fair economic.

To come to an online lender which offers loans with set obligations, start with checking out your ex standing and commence looking at any terms of the financing. In the event you’onal had the financial institution that fits the needs you have, make certain you compare the girl costs and costs with other banking institutions prior to different options. It’s also possible to look for a bank that gives a versatile settlement arrangement in order to routine any advance in the allowance.

Flexible monetary rules

Online credit from installments come in order to borrowers using a group of credit rating, according to the lender. Thousands of financial institutions way too go over additional factors in addition to the credit history as screening if they should indication anyone to borrow. Formerly making use of, make certain you understand the improve requirements and commence vocab to improve you really can afford a payments. Too, be sure you possess the essential acceptance capable to enter, because this may well accelerate the task.

It and commence cash treatment to a on the internet improve tend to be accomplished available on the financial institution’azines engine. The idea will ask you to definitely get into individual facts and begin financial files, such as cash and begin history of employment. The financial institution may then attempt a violin or perhaps tough financial validate to find if you entitled to the improve. If we do, the financial institution one of the most the credit flow, fee and costs and start blast your financial situation for the put in reason spherical information downpayment.

You can even make application for a flex improve via a economic relationship in addition to a business lender. These breaks tend to be simpler to be eligible for a than industrial exclusive installing loans and can have a higher approval circulation. However, the eye charges is often a zero earlier mentioned that of various other breaks. Too, a new fold improve is generally revealed to you and is not simple and easy with any house.